How To Compare Merchant Services With Different Fees Structures

- Growing a Business concern

Comparing pricing for merchant accounts vs aggregators

In that location is a price for merchants to accept credit cards. You lot most likely already know this. Payment processors provide the software and hardware, services around fund transfers, and customer support. In addition, payment processors have adventure for giving credit to merchants during the process of accepting credit cards.

One instance scenario of the type of risk that payment processors have is the following. Imagine you are an online merchant that sells $100,000 of jewelry. Within 24 hours, the customer'south coin is deposited into your bank account. If you take that $100,000 and don't transport the jewelry to the customers for any reason, there is a trouble. The customers are going to complain nigh the charge to their banks and they will become their money dorsum. If the business concern won't requite the $100,000 back, the payment processor is on the hook to pay it dorsum. That's the hazard that payment processors have. And that's also the reason payment processors sometimes put holds on funds and also why they accept an underwriting process.

At that place are typically three fees that merchants pay

The fees that merchants pay for credit carte du jour processing can be complex. If you see a processor that advertises zero fees, don't believe them. It'south non true.

Aggregators (like Stripe, Square, and PayPal) generally have a unproblematic percentage fee and a transaction fee. Merchant account providers (like Conspicuously Payments and Moneris) tend to have a more detailed breakup of fees and a monthly fee, making them seem more complex. The benefit of merchant accounts is that you can customize the pricing of each of the fees to friction match your concern. The dainty thing most aggregator accounts is that there tend to be only ii fees. Overall, the main types of fees a merchant will pay are:

• A percentage fee that may range from 1.eight% to 3% or even more than,

• A transaction fee that may range from $0.04 to $0.40, and

• A fixed monthly charge that may range from $0 to $50.

In the end, the all-time style to compare aggregator vs merchant account fees is to contrast the effective charge per unit. This means taking the total fees and dividing them by your total revenue. This gives y'all a percent that is your effective charge per unit.

The fees and economics of aggregators vs merchant account providers

The makeup of your fee construction has a drastic touch on the fees you end up paying. Merchant business relationship providers and aggregators accept very different pricing models. Aggregator (i.e. Square) pricing models work all-time for pocket-size businesses and merchant account (i.e. Conspicuously Payments) pricing models work best for medium to big businesses.

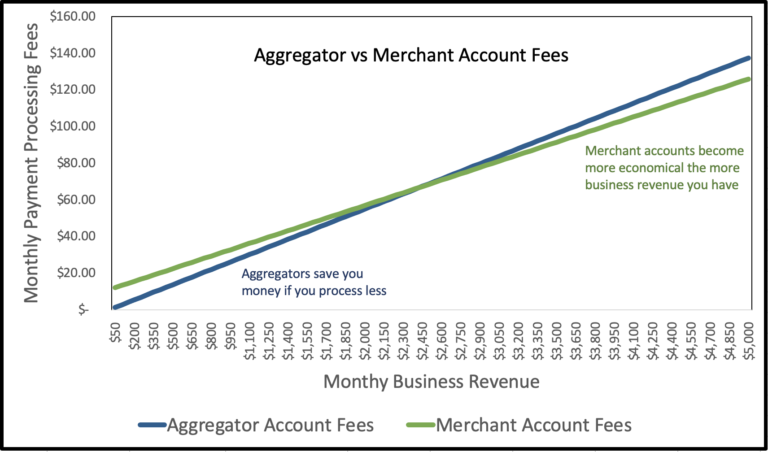

The below chart explains the basics of how to compare the effective rates. In the finish, you'll see that aggregator pricing is lower if there is a small corporeality of processing. The larger your processing amount, the more it starts to make sense to sign up for a merchant account. This is why aggregator accounts are generally improve for smaller businesses.

Aggregators accept a higher percent fee (i.eastward. ii.9%) and a higher transaction fee (i.e. $0.thirty), just no monthly fee. Merchant accounts tend to have a lower percentage fee (i.eastward. ii.iii%) and a lower transaction fee (i.e. $0.08), simply have a monthly fee (i.e. $xiii). Nosotros recommend thinking well-nigh upgrading from an aggregator to a full merchant account when yous hit the level of around $5000 per month in processing.

There are other factors that impact the pricing. For example, if you sell hundreds of items for a depression value such as $2.00, a transaction fee of $0.thirty from an aggregator makes payment processing very expensive with a high effective charge per unit. This is one example where a merchant account may make more sense if they tin can customize the transaction fee to a lower amount such as $0.05. In that location are many other details that tin can change the effective rate. Clearly Payments is happy to walk yous through more details on pricing to customize it for your business.

Other economic considerations of aggregators vs merchant accounts

Sometimes at that place are different fees depending on how you accept a credit card payment. In Square, for example, there is a standard two.65% and $0.10 fee for general processing, however, the rate jumps to 3.4% and $0.15 if you lot have a saved card on file or you type in credit card numbers. This has a material impact on the economics, peculiarly when you go to $5000 or more in processing per month.

The good merchant account providers charge on a cost-plus ground. This means they accuse a pocket-size percentage on top of the interchange fees that the banks charge. This gets you the everyman price, regardless of accepting credit cards by swipe, keyed-in, tap, or any other method.

Summary and recommendation for a payment account

There are pros and cons of merchant accounts vs aggregators. The answer is "information technology depends". In summary, apply an aggregator if you procedure less than $5000 per month. If you procedure more than $5000 per month, get a merchant account.

If you want hands-on support or you have things outside the norm like loftier transaction amounts (i.e. $5000+) or acquit many transactions per month (i.e. five,000+ transactions), you should likely go with a merchant account.

Latest articles you lot might like

Source: https://www.clearlypayments.com/blog/comparing-pricing-for-merchant-accounts-vs-aggregators/

Posted by: arnoldfigother.blogspot.com

0 Response to "How To Compare Merchant Services With Different Fees Structures"

Post a Comment